Table of Contents

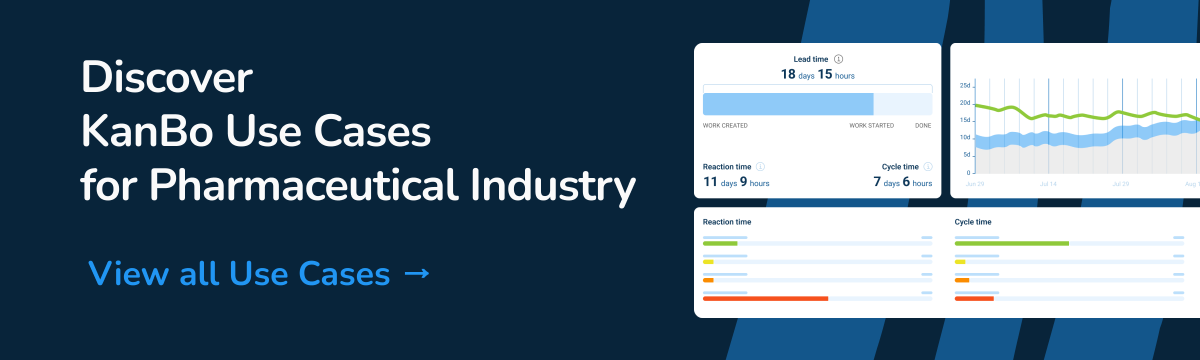

KanBo – The Pharma-Focused Work Coordination Maestro

Experience ultimate task alignment, communication and collaboration

Trusted globally, KanBo, bridges the gap between management and engineering in complex pharmaceutical organizations. Seamless coordination, advanced project planning, and outstanding leadership are made possible through our versatile software. Stride toward your mission-critical goals with superior collaboration and communication.

KanBo Associate Director, Tax Planning Pharmaceutical Collaboration Mastery

What do readers need to know about this challenge?

In the pharmaceutical sector, the role of an Associate Director, Tax Planning encompasses navigating complex collaborations within dynamic teams to provide specialized tax technical advice. This challenge involves continual engagement with varied business units and corporate functions, consistent application of evolving tax laws, and the development of strategic initiatives to manage the organization's tax position effectively.

What reader can do with KanBo to solve this challenge?

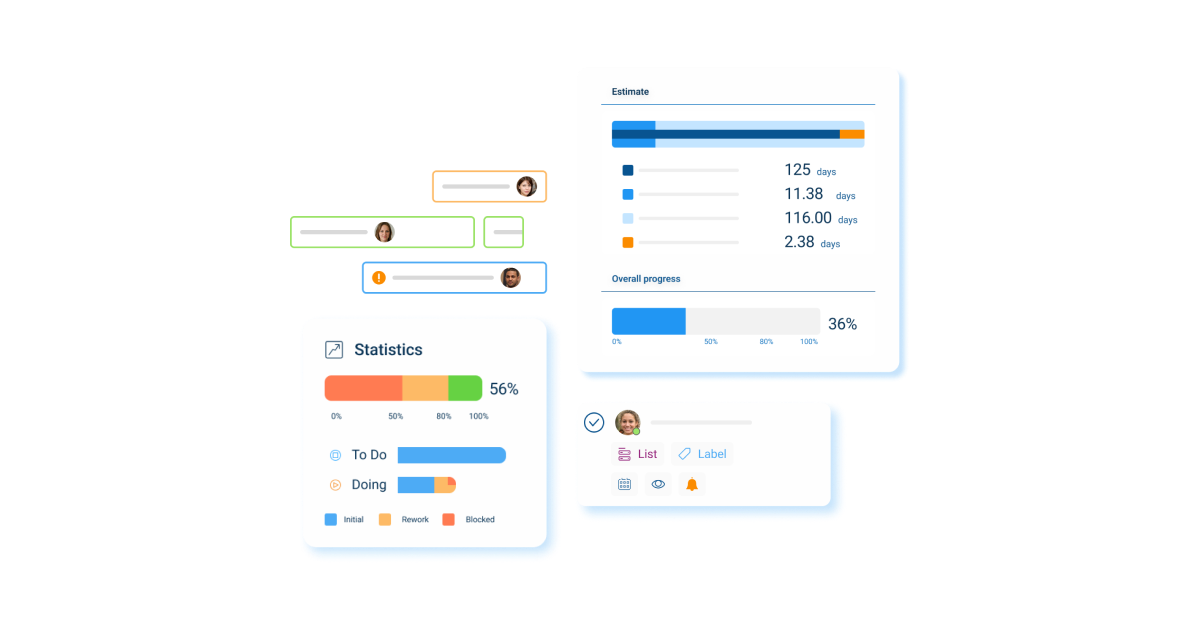

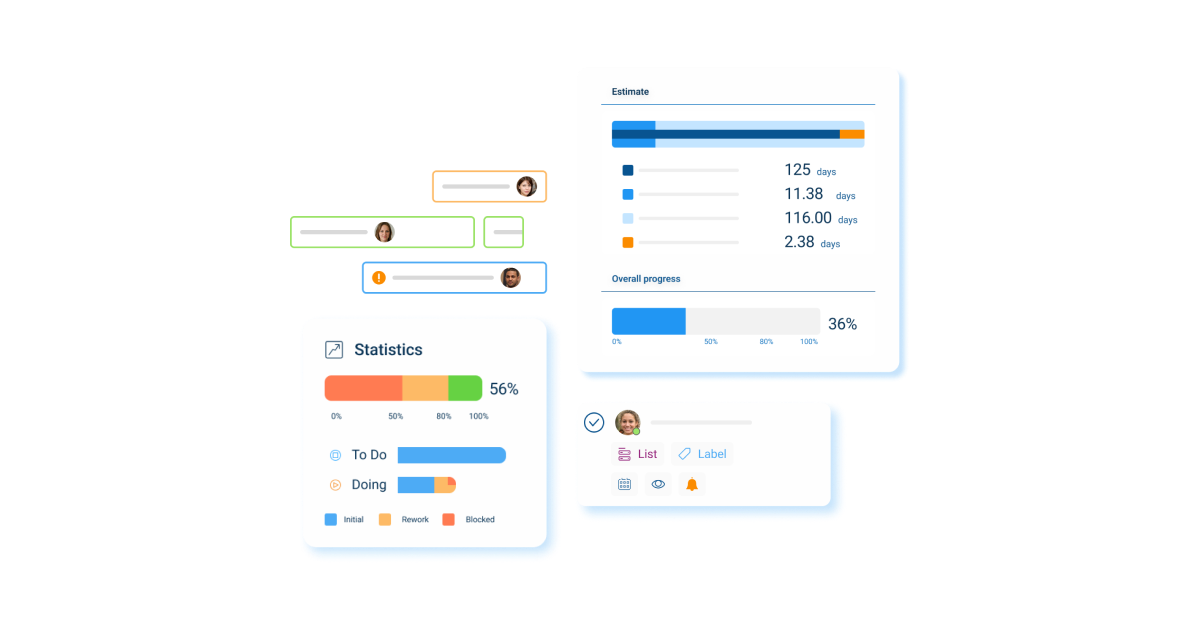

- Expand Collaborative Capacity: Employ user activity streams to keep track of individual contributions, fostering clarity of engagement and transparency across departments and teams.

- Legislative Impact Analysis: Use card filtering to organize and access specific tax-related information swiftly, allowing for a timely assessment of legislative changes and their potential impacts.

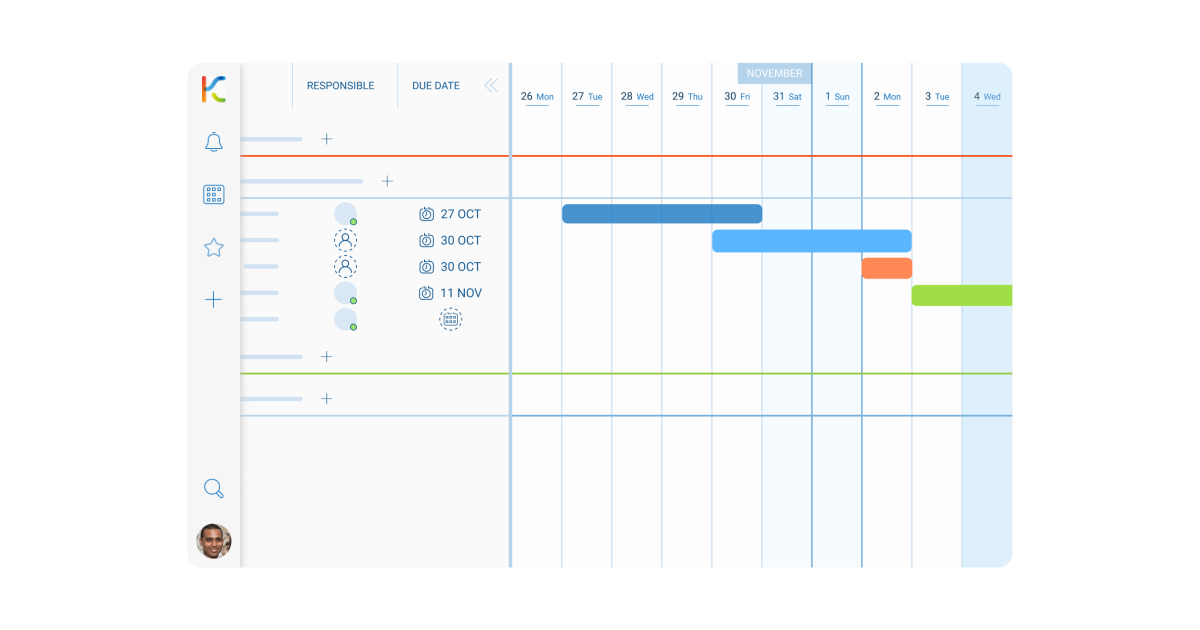

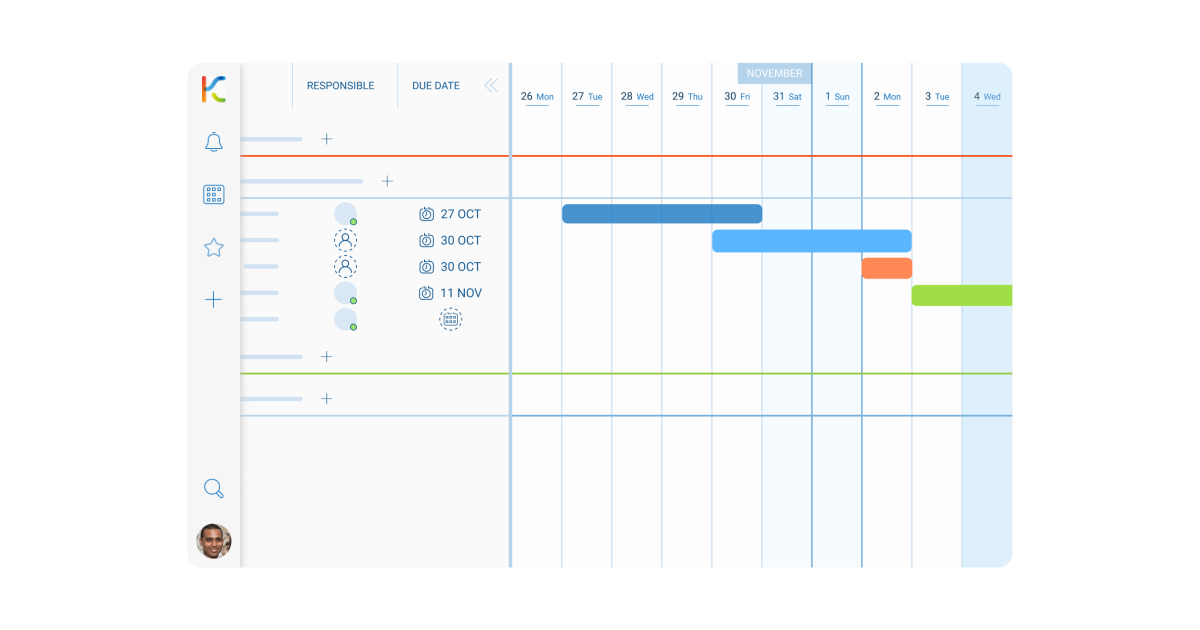

- Strategic Planning: Utilize the Gantt Chart view to outline and manage the execution of complex tax planning strategies over time, ensuring all critical milestones are met.

- Cross-Functional Integration: Create spaces to define specific tax-related projects, providing a structured environment to streamline the collaboration process within the organization.

- Document Centralization: Apply document sources to cards for organizing critical tax documents, ensuring all stakeholders have easy and immediate access to necessary information within the context of their tasks.

- Real-Time Updates: Setup notifications to keep all tax team members and stakeholders informed of new developments, changes in tax policy, or adjustments in collaborative projects.

What reader can expect after solving this challenge?

Upon effectively implementing KanBo for the challenges faced in tax planning collaboration, the reader can expect a more cohesive and transparent workflow, where information is readily accessible, and cross-functional teams are aligned with tax strategies. There will be a significant reduction in the risks associated with tax compliance due to more efficient tracking of legislative revisions. In the future, the Associate Director, Tax Planning can anticipate deeper integrations within KanBo to provide even more robust data analysis tools, enhancing decision-making capabilities and facilitating proactive tax planning. As a result, KanBo's comprehensive suite of features will continue to support the evolving needs of tax planning professionals, driving efficiency, and accuracy in one of the most complex areas of pharmaceutical management.

Table of Contents

KanBo – The Pharma-Focused Work Coordination Maestro

Experience ultimate task alignment, communication and collaboration

Trusted globally, KanBo, bridges the gap between management and engineering in complex pharmaceutical organizations. Seamless coordination, advanced project planning, and outstanding leadership are made possible through our versatile software. Stride toward your mission-critical goals with superior collaboration and communication.

KanBo Associate Director, Tax Planning Pharmaceutical Collaboration Mastery

What do readers need to know about this challenge?

In the pharmaceutical sector, the role of an Associate Director, Tax Planning encompasses navigating complex collaborations within dynamic teams to provide specialized tax technical advice. This challenge involves continual engagement with varied business units and corporate functions, consistent application of evolving tax laws, and the development of strategic initiatives to manage the organization's tax position effectively.

What reader can do with KanBo to solve this challenge?

- Expand Collaborative Capacity: Employ user activity streams to keep track of individual contributions, fostering clarity of engagement and transparency across departments and teams.

- Legislative Impact Analysis: Use card filtering to organize and access specific tax-related information swiftly, allowing for a timely assessment of legislative changes and their potential impacts.

- Strategic Planning: Utilize the Gantt Chart view to outline and manage the execution of complex tax planning strategies over time, ensuring all critical milestones are met.

- Cross-Functional Integration: Create spaces to define specific tax-related projects, providing a structured environment to streamline the collaboration process within the organization.

- Document Centralization: Apply document sources to cards for organizing critical tax documents, ensuring all stakeholders have easy and immediate access to necessary information within the context of their tasks.

- Real-Time Updates: Setup notifications to keep all tax team members and stakeholders informed of new developments, changes in tax policy, or adjustments in collaborative projects.

What reader can expect after solving this challenge?

Upon effectively implementing KanBo for the challenges faced in tax planning collaboration, the reader can expect a more cohesive and transparent workflow, where information is readily accessible, and cross-functional teams are aligned with tax strategies. There will be a significant reduction in the risks associated with tax compliance due to more efficient tracking of legislative revisions. In the future, the Associate Director, Tax Planning can anticipate deeper integrations within KanBo to provide even more robust data analysis tools, enhancing decision-making capabilities and facilitating proactive tax planning. As a result, KanBo's comprehensive suite of features will continue to support the evolving needs of tax planning professionals, driving efficiency, and accuracy in one of the most complex areas of pharmaceutical management.